- Home

- Can I calculate taxes using only latitude and longitude?

As requested by Avalara, the connector has been updated to not send latitude and longitude by default in tax calculations.

This is due to the Streamlined Sales Tax (SST) requirements implemented by Avalara, which mandate using street-level address information for regular tax calculations.

Using geo-coordinates is only expected for specific scenarios such as product and service deliveries at oil/gas wells, timber harvesting sites, or new construction locations.

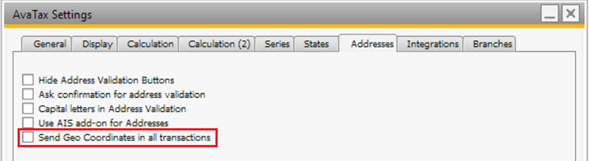

However, if you need to permanently configure the add-on to use this type of address, you can enable it through the option highlighted in the following image.

If you only occasionally need to calculate taxes using ship-to geo-coordinates instead of a street-level address, you do not need to change anything in the settings.

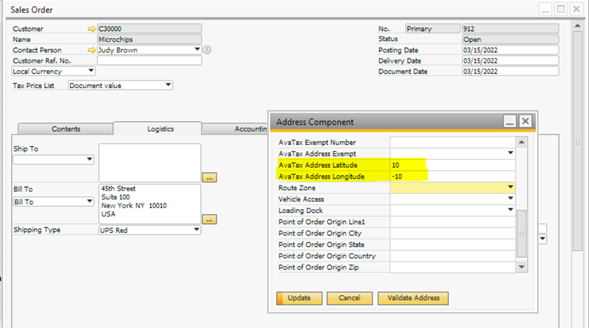

Simply make sure that, within the address component window:

-

The Street, City, and Zip Code fields are empty.

-

The State and Country fields are filled.

-

The Latitude and Longitude values are defined.

Finally, ensure the AvaTax Ship-To Type is set to Doc. Ship To Address for each document line intended to use coordinates as the ship-to.

Following this procedure, Avalara will calculate taxes for the document based on the latitude and longitude of the destination.